When mobile booking and payment become part of metasearch, it will be even more important to have a single party solution with a seamless closed loop marketing solution.

When mobile booking and payment become part of metasearch, it will be even more important to have a single party solution with a seamless closed loop marketing solution.

Metasearch continues to be one of the hottest topics for the hospitality industry. We have already written two articles about metasearch and hosted a webinar with Tnooz to give greater insight regarding the challenges and solutions available to hoteliers.

The rapid growth and changing landscape of metasearch mean that the “old” rules of metasearch marketing no longer apply. Marketers are facing many new problems and dilemmas.

Is metasearch a marketing channel or distribution channel?

Metasearch used to be a simple concept to grasp when it was defined simply as a marketing channel. Now it is getting more complicated. Increasingly, many major metasearch sites like TripAdvisor are promoting booking and payment functions, similar to an OTA, despite many differences.

Many hotel marketers may balk at the idea that a booking would be completed on a metasearch site. To solve this dilemma, we have to step back and ask, what is the business objective?

If the ultimate objective is to get more bookings at a reasonable cost, then we should embrace this change. Metasearch is no longer just a marketing channel, nor is it simply an OTA type of distribution channel. Perhaps it should be called a direct distribution-marketing channel, through which you can get bookings from direct customers on your branded site or app.

If the ultimate objective is to get more bookings at a reasonable cost, then we should embrace this change. Metasearch is no longer just a marketing channel, nor is it simply an OTA type of distribution channel. Perhaps it should be called a direct distribution-marketing channel, through which you can get bookings from direct customers on your branded site or app.

How much budget should be allocated for metasearch?

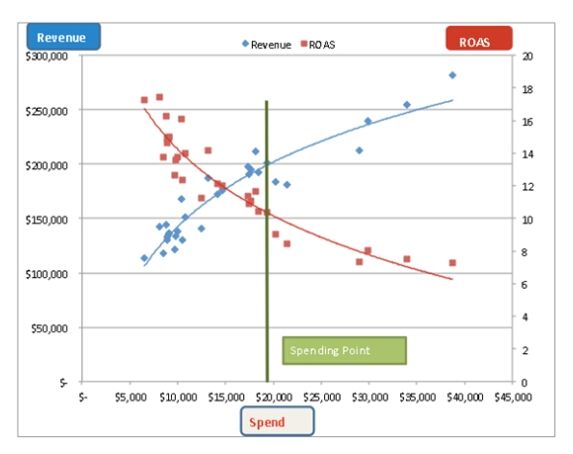

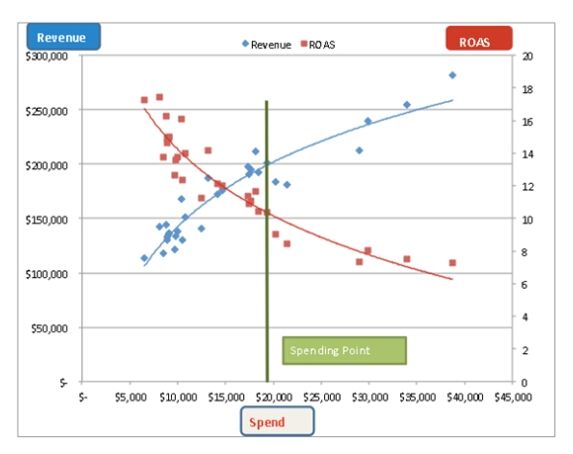

Consider this example: recently one of our clients was having a great month, as its metasearch traffic and booking volume reached an all-time high with a targeted ROI. Then we got a call from the client telling us that the entire monthly marketing budget for metasearch had been consumed, so they asked us to pause their metasearch campaign for the remainder of the month.

In the meantime, OTAs continued to generate and deliver bookings from metasearch, and as a result, the hotels ended up paying higher commissions on the same bookings that could have been generated from our metasearch campaign.

The short and simple lesson here is that if the cost of a metasearch-generated booking is lower than or even the same as the commission you are paying OTAs, you should keep your budget for metasearch open.

Some vendors’ bidding solutions support automated bidding such as bulk bidding, which can set the bids in bulk, sometimes using some rules created by campaign managers. However, optimising just one property on one channel is not the best approach—finding the best combination of bids for the whole portfolio is what will maximise the total revenue or profit.

Some vendors’ bidding solutions support automated bidding such as bulk bidding, which can set the bids in bulk, sometimes using some rules created by campaign managers. However, optimising just one property on one channel is not the best approach—finding the best combination of bids for the whole portfolio is what will maximise the total revenue or profit.

Given so many combinations and factors, it is nearly impossible for any human being to manually optimise bids. Manually designed rules and bulk bidding will simply not achieve the optimum results that come from the best portfolio optimisation algorithms and mathematical models based on years of data.

Should I use different vendors for price feed and bidding management?

Finding the right bidding tool is not the only challenge. In previous articles, we listed three main challenges for metasearch marketing: 1) connectivity between CRS’ and the metasearch channels, 2) caching solutions to buffer CRS’ from large shopping traffic volume, and 3) controlling campaigns through effective bid management.

Most vendors can address only one or two of these. While it is technically possible to separate price feed connectivity and campaign bidding management in some cases, it is inefficient, expensive and functionally sub-optimal to divide the work for s single project between two separate vendors.

Take Google Hotel Price Ad (HPA) metasearch campaigns for example. The success of Google HPA relies on both the price feed and bidding, along with other settings, which are intertwined closely in Google’s API. It is very difficult to integrate different solutions.

When a hotel is not shown on Google Hotel Finder, there are many possible reasons: the hotel may not be indexed correctly on Google, the price feed setting may not be correct, the price may not be accurate, or the bidding may not be high enough. Obviously, having two separate vendors manage the price feed and the bidding introduces even more complexity into an equation that everyone is trying to simplify, and if something goes wrong, who fixes it?

Metasearch marketing requires a holistic strategy that considers an integrated approach toward price feed and bid management. For example: You should be able to adjust bidding depending on data such as room price and room quantity, which are key components of revenue management and useful bidding signals to improve ROI.

Metasearch marketing requires a holistic strategy that considers an integrated approach toward price feed and bid management. For example: You should be able to adjust bidding depending on data such as room price and room quantity, which are key components of revenue management and useful bidding signals to improve ROI.

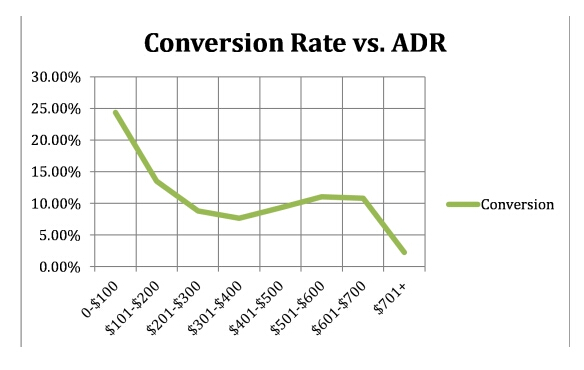

This chart shows the relationship between conversion rate and ADR for one hotel chain. As you can see, the conversion rate fluctuates quite a bit, dropping as prices rise, increasing again in the $500 to $700 range, then dropping rapidly when room prices exceed $700.

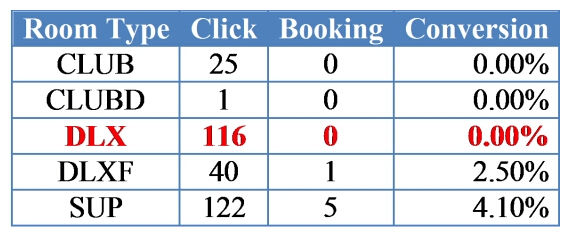

You should be able to optimise inventory including room types or rate plans in real time according to campaign performance. The chart below shows that different room types may have very different conversion rates on different metasearch channels. Room Type DLX has 116 clicks in this period, but 0 bookings. Thus the campaign management tool can immediately disable this low performing room type and investigate why the conversion is so low. This is very difficult to achieve when you have one vendor managing inventory and the other responsible for optimising campaign performance.

Conclusion

In the new age of metasearch marketing, product inventory, pricing, and campaign management are closely intertwined. When mobile booking and payment become part of metasearch, it is even more important to have a single party with a seamless closed loop marketing solution: connect and cache (price feed/cache), control (bidding and optimisation), and finally conversion (booking integration).